A finance agency is not typically responsible for unsafe living conditions. Their role focuses on financial transactions rather than property maintenance.

Ensuring safe living conditions is critical to rental management and housing regulations. While finance agencies play crucial roles in managing funds and investments, they usually do not directly address the physical state of living spaces. Instead, landlords, property management companies, and local housing authorities are commonly charged with maintaining safe and habitable tenant environments.

These stakeholders must comply with health and safety standards to prevent unsafe conditions. In real estate financing, a finance agency’s influence over living conditions might be indirect, such as when financing renovation projects or enforcing financial penalties for non-compliance with safety regulations. Homebuyers and renters rely on these organizations to uphold housing quality and safety standards, ensuring financial dealings do not compromise living conditions.

- Introduction To Financial Agency Liability

- When Can Finance Agencies Be Held Liable?

- Protection And Prevention Measures

- Legal Recourse And Consumer Protection

- The Impact Of Financial Agency Liability On The Housing Market

- Frequently Asked Questions On Can A Finance Agency Be Responsible For Unsafe Living Conditions

- Conclusion

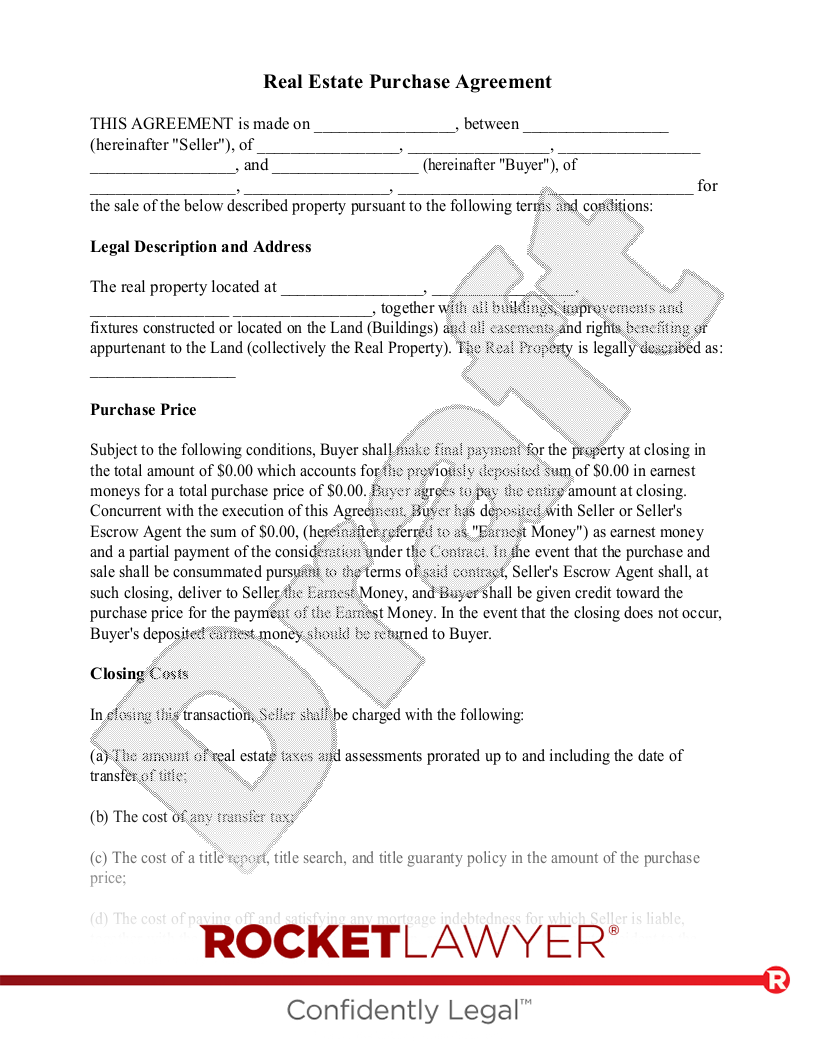

Credit: www.rocketlawyer.com

Introduction To Financial Agency Liability

Finance agencies play a vital role in helping people become homeowners. They give money through loans for people to buy houses. These agencies must follow specific laws to make sure they do it right.

The laws for finance agencies are complex. Agencies need to know and follow these laws. If they don’t, a house could be wrong and unsafe.

The role of finance agencies is not just about giving money. They are part of a system that includes looking after the houses they fund. If a finance agency is not careful, they could become responsible. Responsible means they might have to fix problems with the house.

When Can Finance Agencies Be Held Liable?

Finance agencies must always watch where they send money. They should check that housing conditions are safe. If they don’t, people could live unsafely. This is the agency’s duty of care.

Legal cases show when agencies were responsible. They didn’t do enough research on housing safety. This caused dangerous living spaces. The court said it was their fault.

Agencies need to spot bad housing funding risks. They can be accountable for unsafe homes. It’s the point where they could have known better. In these cases, they must answer for negligence.

Protection And Prevention Measures

Finance agencies play a pivotal role in ensuring safe living conditions. They must employ risk assessment strategies to identify potential hazards. Assessments should cover both financial risks and physical property conditions.

Insurance policies and indemnity clauses are crucial. They safeguard against unexpected events leading to unsafe living. Agencies should emphasize the importance of these protections to clients.

Another critical aspect is fostering knowledge through educational programs. Finance agencies can lead initiatives that inform borrowers about safety standards in housing. Such efforts contribute to the prevention of risky living situations.

Legal Recourse And Consumer Protection

Homebuyers have rights and legal safeguards against unsafe homes. These legal provisions ensure that homes meet safety standards. Homebuyers can seek legal action if a finance agency fails to reveal hazards. The litigation process may involve several steps. First, evidence of the unsafe condition must be gathered. Then, a legal complaint is filed against the agency. Regulatory bodies play a crucial role in enforcing compliance with housing laws. These organizations have the power to investigate and penalize finance agencies for misconduct.

The Impact Of Financial Agency Liability On The Housing Market

Financial agencies hold a crucial role in ensuring safe living conditions. These entities influence the housing market greatly. A shift in accountability can lead to significant economic impacts. Home loans might become more challenging to get if agencies need to cover risks for unsafe environments.

Policy shifts within agencies are evident following major liability cases. Agencies are now more cautious in their lending practices. This shift aims to prevent any future liabilities that can arise from neglecting the safety of living conditions.

| Timeframe | Policy Change | Impact on Housing |

|---|---|---|

| Post-Liability | Stricter Lending Rules | Increased Safety Checks |

| Future Outlook | Continued Adjustments | Stable Housing Markets |

A forward-looking perspective suggests ongoing changes. Agencies will likely continue to redefine their roles. This effort balances financial soundness with the public’s right to safe housing.

:max_bytes(150000):strip_icc()/moralhazard-final-e071d0d67fc0429896cf95f25e915b85.jpg)

Credit: www.investopedia.com

Credit: www.bankrate.com

Frequently Asked Questions On Can A Finance Agency Be Responsible For Unsafe Living Conditions

What Liabilities Do Finance Agencies Have?

Finance agencies generally do not have direct responsibility for living conditions. However, if they fund or manage properties that fail to meet safety standards, they may be liable for negligence or violating tenant rights laws.

Can Finance Agencies Affect Housing Safety?

While finance agencies primarily deal with funding, their investment decisions can indirectly influence housing safety. They may enforce standards that property owners must meet to receive financing, affecting living conditions.

How Do Finance Agencies Ensure Habitable Properties?

Finance agencies might have policies that require routine inspections and compliance checks. These ensure properties receiving funding or investment maintain safe and habitable living conditions.

What Are Tenants’ Rights Against Unsafe Conditions?

Tenants have the right to live in safe, healthy environments. If living conditions are unsafe, tenants can report to local housing authorities, seek legal counsel, or demand action from landlords, potentially implicating finance agencies involved in the property.

Conclusion

Understanding the role of finance agencies in housing is pivotal. They don’t directly manage properties, but their decisions influence living standards. These entities can indirectly safeguard against unsafe accommodations by ensuring responsible lending and investing. Let’s hold them accountable for their impact on our communities.

Your security at home may depend on it.