American Airlines travel insurance offers for its customers, covering trip cancellations, medical emergencies, and other unforeseen circumstances during travel. This insurance ensures peace of mind and financial protection for travelers throughout their journey.

By choosing American Airlines’ travel insurance, customers can have a worry-free travel experience, knowing they are protected against unexpected events that may disrupt their plans. Whether it’s a last-minute cancellation or a medical emergency overseas, American Airlines’ travel insurance covers you.

With comprehensive coverage options, travelers can rest assured that their travel investment is safeguarded, allowing them to focus on enjoying their trip without any unnecessary stress.

Credit: www.nerdwallet.com

1. What Is Travel Insurance

Travel insurance is a type of coverage that provides financial protection against unforeseen events while traveling. It protects travelers from unexpected expenses such as trip cancellation, lost baggage, medical emergencies, and flight delays.

Definition Of Travel Insurance

Travel insurance is a contractual agreement between the insured and the insurance company, where the insured pays a premium in exchange for coverage during their travel period. It typically includes many benefits and can be customized based on the traveler’s needs and preferences.

Importance Of Travel Insurance

Travel insurance plays a crucial role in mitigating financial risks associated with travel. Knowing that you will be financially protected if an unforeseen event occurs offers peace of mind. With travel insurance, you can avoid significant out-of-pocket expenses, especially in situations beyond your control.

2. American Airlines Travel Insurance

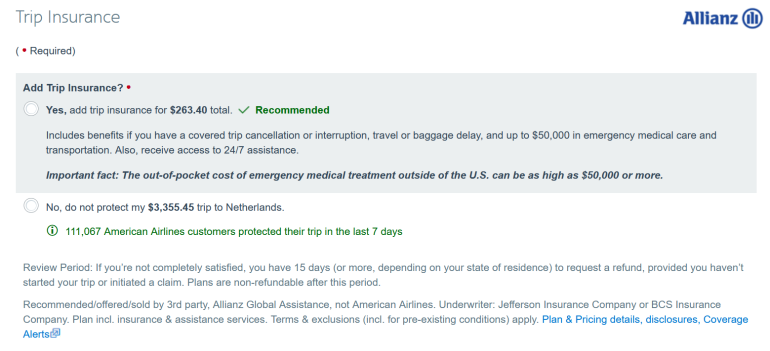

American Airlines Travel Insurance provides comprehensive coverage options for travelers. The insurance offers convenience and peace of mind, protecting you throughout your journey. With American Airlines Travel Insurance, you can choose from various coverage options based on your needs and preferences.

The insurance offers an overview of the coverage options available, allowing you to select the one that suits you best. You can opt for coverage for trip cancellation, trip interruption, baggage delay, and more. The insurance also provides medical expense coverage, including emergency medical and dental expenses.

There are several benefits to choosing American Airlines Travel Insurance. Firstly, it provides financial protection against unforeseen circumstances, ensuring you are not left out of pocket in case of trip cancellation or baggage loss. Additionally, the insurance offers assistance services such as 24/7 travel assistance and concierge services, ensuring you have support throughout your trip.

Choosing American Airlines Travel Insurance gives you the peace of mind of knowing you are covered for any unexpected events that may occur during your travels.

3. How To Purchase American Airlines Travel Insurance

American Airlines offers travel insurance to give customers peace of mind during their trip. There are two convenient ways to purchase travel insurance: online and by phone.

Online Purchase Process

To purchase travel insurance online, follow these steps:

- Visit the American Airlines website.

- Navigate to the travel insurance section.

- Select the type of coverage you need, such as medical, trip cancellation, or baggage protection.

- Enter your travel details, including trip dates and destination.

- Review the coverage options and prices.

- Proceed to the checkout page and provide your personal and payment information.

- Confirm your purchase and receive your travel insurance policy via email.

Phone Purchase Process

If you prefer to purchase travel insurance by phone, follow these steps:

- Dial the American Airlines customer service number.

- Press the appropriate number to speak to a representative.

- Inform the representative that you would like to purchase travel insurance.

- Provide the necessary information, such as trip details and personal information.

- Listen to the coverage options and prices offered by the representative.

- Provide your payment information to complete the purchase.

- Receive your travel insurance policy via email.

Credit: www.aa.com

Frequently Asked Questions On American Airlines Travel Insurance

What Is Trip Insurance On American Airlines?

Trip insurance on American Airlines protects passengers against unforeseen events during their trip, such as trip cancellations, delays, lost luggage, or medical emergencies. It provides peace of mind and financial protection to travelers throughout their journey.

What Does Trip Insurance Cover?

Trip insurance covers a range of unforeseen events: trip cancellations, delays, medical expenses, emergency medical evacuations, lost luggage, and theft. It provides financial protection and peace of mind while traveling.

What Does Airline Ticket Insurance Cover?

Airline ticket insurance typically covers expenses like trip cancellation, flight delays, lost luggage, and medical emergencies during your journey. It offers financial protection and reimburses you for unforeseen circumstances that may disrupt your travel plans.

Can I Add Travel Insurance After Booking Flight?

Yes, you can add travel insurance after booking your flight. It’s a flexible option that offers coverage for unexpected situations during your trip. Don’t worry if you didn’t purchase it initially; you can still obtain protection by adding it later.

Conclusion

American Airlines offers a comprehensive travel insurance policy that provides peace of mind for travelers. With its wide range of coverage options and 24/7 assistance, passengers can feel confident that they are protected against unforeseen events and emergencies. American Airlines travel insurance covers you, whether it’s trip cancellation, medical emergencies, or lost baggage.

Don’t let unexpected circumstances ruin your travel experience – invest in travel insurance for a worry-free journey.